SARVA HARYANA GRAMIN BANK GOING INTO SATYAM’S RAMALINGA RAJU WAY…

SARVA HARYANA GRAMIN BANK GOING INTO SATYAM’S RAMALINGA RAJU WAY…

HARIYANA ( Faridabad ) :- Sh Mukesh Joshi, Chief Co-ordinator, GGBWO & SHGBOO has been continuously highlighting the highhandedness of SHGB Management who is violating all norms for personal gains by posting wrong information in public domain and hiding the mismanagement and lackluster SHGB administration at different forum – be it Vigilance Commission, Central Bureau of Investigation, Prime Minister’s Office, Finance Minister’s Office, or even PNB or NABARD Head offices.

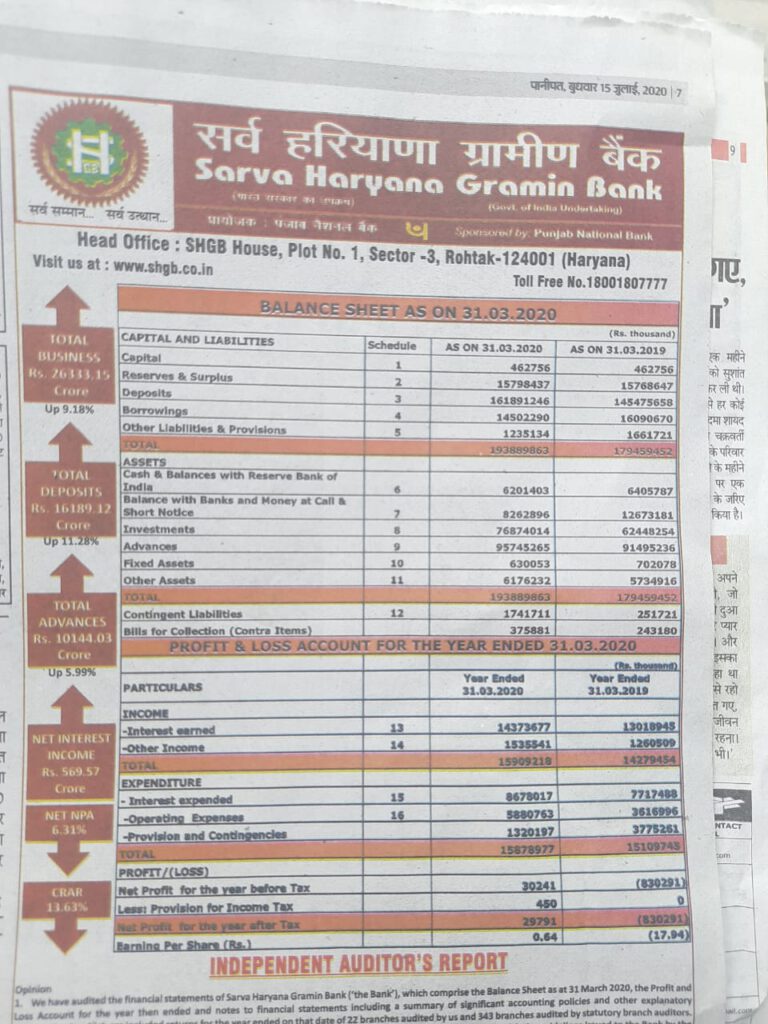

It has already been informed vide various letters, press note, memorandum etc how the SHGB management had been wrongly posting the Income in its Balance sheet since the amalgamation of GGB and HGB by open violations of RBI guidelines and other statutory guidelines. This is like making of another SATYAM – Ramalinga Raju – like frauds, when the Bank is showing the profits in the book, but there is no real Income.

We have earlier already highlighted that SHGB Management has posted a total profit of around 509 crores from the years 2014 to 2018 and have paid the Income tax on this profit to the tune of approximately 200 crores. But in actual, there were no profits in these years and profits have been reported by the Bank by rigging the Books of the Bank in collusion with Auditors. When this entire intentional violations were reported by Sh Mukesh Joshi, Bank has suddenly posted a loss of 84 crores in the year ended on 31.03.2019 and again on this FY ending on 31.03.2020, Bank has shown a marginal income of just Rs. 10 lacs.

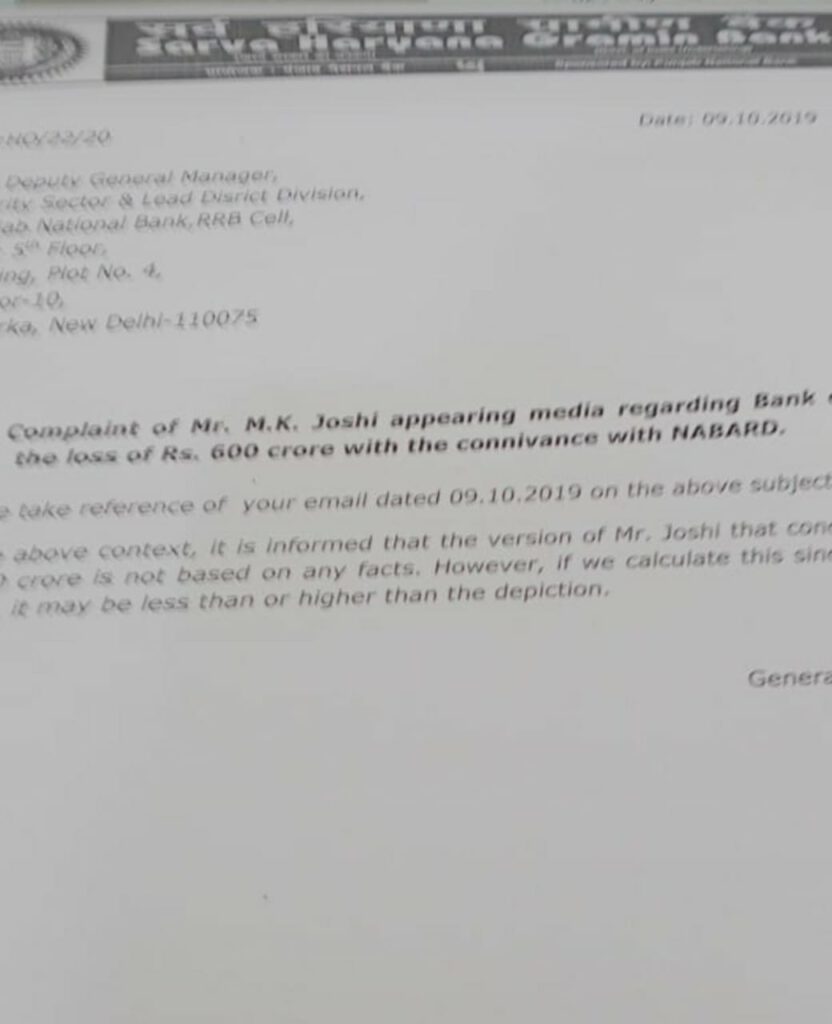

But the larger and true picture is very murky. As per letter dated 09.10.2019 written by SHGB GM to NABARD, PNB, and Finance Ministry, the SHGB Management has accepted that in the past the classification of the account was not done correctly and actual loss to the Bank could have been more than 600 crores against the reported figures since the amalgamation of GGB and HGB.

Even, as per Audited Balance Sheet of the Bank as on 31.03.2020, the Gross NPA amount is shown as around Rs. 1100 crores, but as per Bank’s internal report, the tentative NPA figures of the Bank in the month of Feb 2020 was Rs. 1700 cores. Again, in this year also Bank has hidden around 600 crores NPA which if reported would have put the Bank’s into loss of around 200 crores considering the various provisioning and reversal of wrongly booked interest income.

This entire manipulation in the Books of accounts is being done by the Management with collusion of the Auditors. This is very obvious by the Auditor’s report on the previous year Balance sheet, when Auditors have clearly mentioned the above violations of the Bank and refused to sign the Balance Sheet. Then SHGB Management brought the new Central Auditors, without the permission from the Competent authority, and got the Audit reports signed by them with rigged accounts. It is worth mentioning that the Bank is getting its accounts audited from the TASKY Associates for the last 3 years against the statutory guidelines where the same auditors are not allowed to inspect the Books of accounts for continuously three years and that too when this auditor is not in the approved list of Central Auditors by Govt of India. This has been done to keep hiding the previous misdeeds of the Bank management in terms of presenting the rigged accounts in front of government for personal gains.

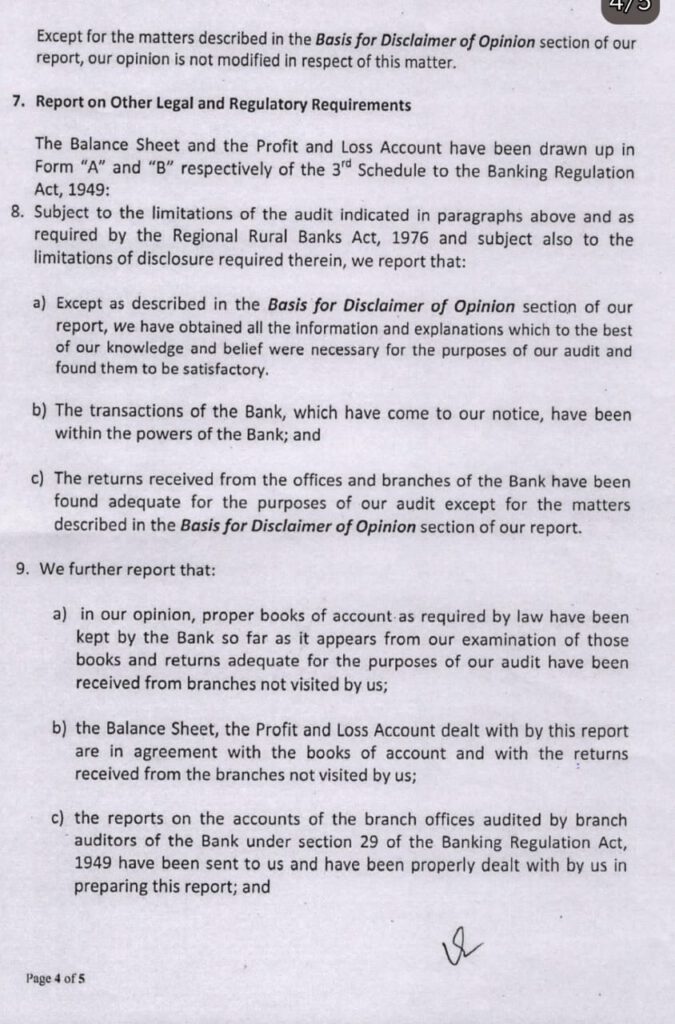

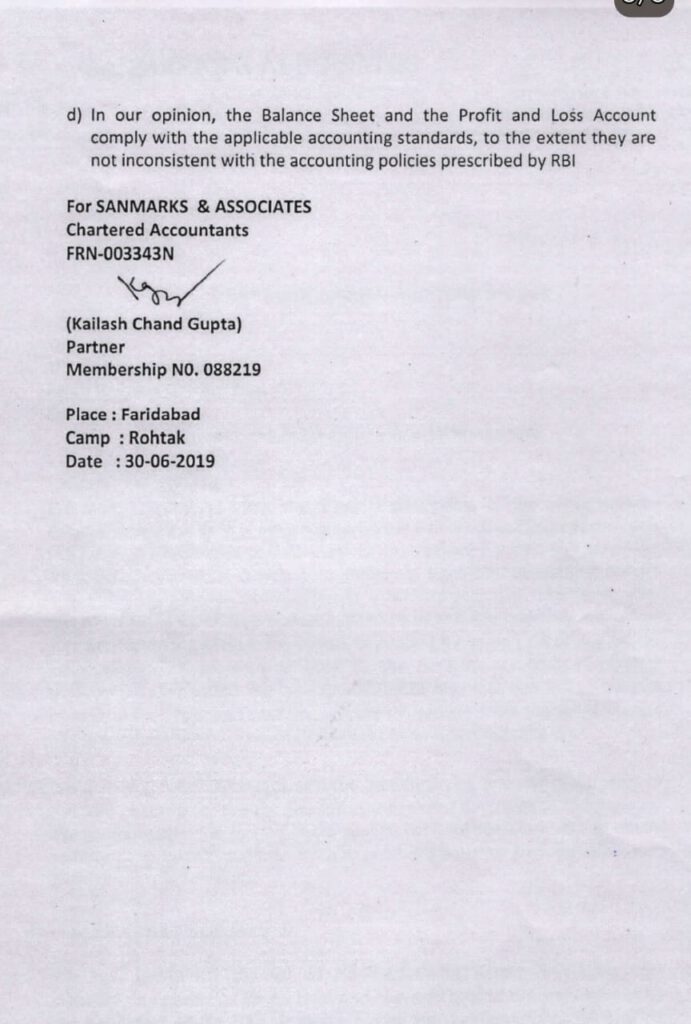

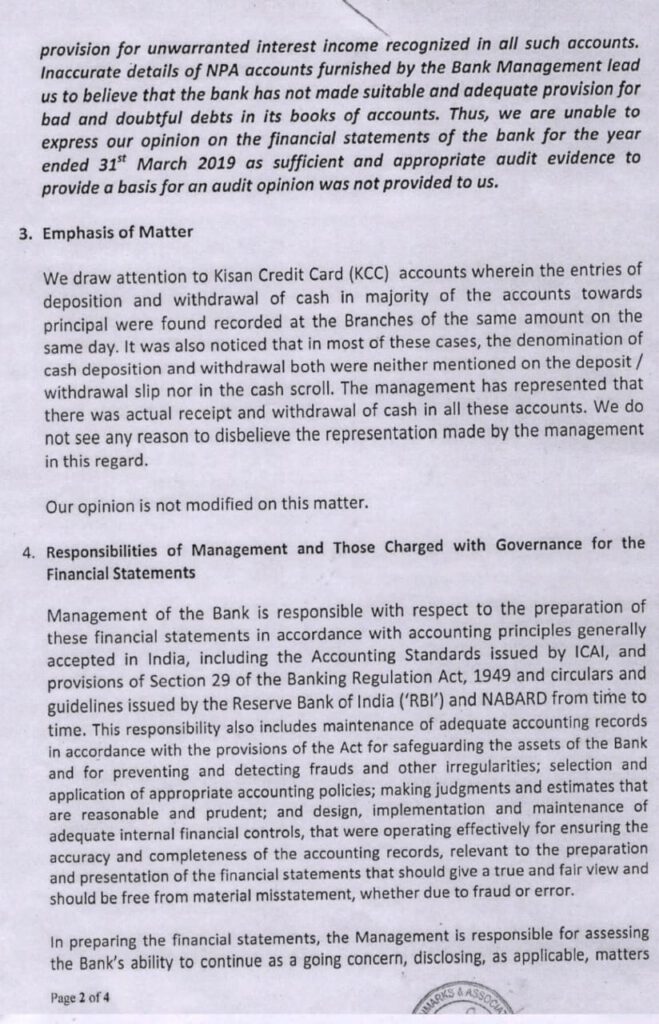

This same assertion has been accepted and vetted by the Bank’s auditors SANMARKS AND ASSOCIATES wherein auditor’s have mentioned in the annual report that – “Majority of accounts reported as NPA had become NPA in years prior to its identification by the Bank. However the Bank have not classified these accounts NPA in years in which they had actually become NPA. Consequently Bank has not created provisions for Bad and Doubtful Debts in respect of these accounts in accordance with Prudential Norms on Income Recognition, Asset Classification and Provisioning pertaining to Advances laid down by Reserve Bank of India. Further, Bank has not created any suitable provision for interest recognized in violation of RBI Norms in respect of the above accounts in the years prior to current financial year. This delayed classification and unwarranted recognition of interest income on all such accounts in earlier years was in total violation of RBI norms.”

Further, the auditors went on to mention that – “ Bank has provided us details of NPA accounts with incorrect date of actual NPA and consequent inadequate provisions for bad and doubtful debts in respect of these NPA accounts. Accordingly, we were not provided sufficient appropriate audit to provide a basis of audit opinion.”

Here it is worth highlighting that The RBI has issued guidelines to all banks that when an account is classified as NPA, the entire unrealized interest to be reversed. But in the SHGB, no such practice is adopted and the interest is reversed as per the wishes of Chairman and interest income is booked to income and income tax is paid on the FAKE income, thus the chairman of the Bank must be held responsible for the loss to the Bank. It is more so demanding when the SHGB Management is so harsh to their employees that the employees of the SHGB gets sacked / suspended / terminated even for minor lapses such as Non – issuance of cheque book or delay in the processing of loans or even on the grounds of FAKE customer’s complaint when even customers does not present themselves personally to vet their complaint; but on the instances of such large scale rigging of Books of accounts no disciplinary proceedings have been even initiated against the SHGB Management by their bosses – PNB Management and this showeth some collusion by a handful of PNB management who is safeguarding these wrongdoings.

These documentds are on record with Bank Management, Finance Ministry, Nabard, and PNB. Despite all these no strict action has been initiated yet by the PNB or the Finance Ministry against the erring official of SHGB Management of whom Sh A K Nanda was on the forefront who violated all norms, bribed the system at all stages, and still sitting in the safe heaven.

Just, look at the audited balance sheet of Bank, (copy attached), wherein it is clearly reported as NPA of the Bank as on 31.03.2016 as 328 crores, as on 31.03.2017 as 327 crores, and NPA as on 31.03.2018 as 580 crores and as on 31.09.2018 as 790 croes.It clearly shows the sudden spike in the NPA of the Bank from 2017 to 2018, almost 90 percent rise. Again within six months, the management has shown another 210 cores as bad assets, taking the NPA figures to 790 crores as on 30.09.2018. Again, the NPA figure of the Bank as on 31.03.2019 is around approx Rs. 1200 croes which is again 50 percent more than the figures reported six months before.

Actually, these accounts are NPA for last 4 or 5 years, and some were even from last 7 or 8 years; but they were not classified as NPA by the Bank management for their personal gain. Since these accounts were NPA for past 4 or 5 years, but not classified, hence the interest charged on these accounts were taken as the Bank’s business whereas in reality, there was no real earning by the Bank in these last 4 or 5 years from these accounts and earning shown by Bank from these accounts were only in books not in reality. But despite these, Bank has paid many hundred crores as Income tax but actually there was no tax liability and it is totally waste of public money. These accounts rigging were done by this SHGB management for their personal gain.

The real motive behind showing the Bank’s in profit was that – when Bank’s are in profit, these GMs and Chairman, who are from PNB, possess immense power and gets many personal benefits which are of individual type in nature; and these powers and benefits stands seized if the Bank is in loss. So, just for the sake of their personal gain, they rigged the Bank’s books, showed the Bank’s in profit, and the irony of the matter is that they also made the auditors accomplice in this act. Of course, auditors must have been bribed substantially to sign these rigged accounts for last 4 years.

Similarly, one more shrewd reason for showing the profit over these years was to keep the recruitment and promotions open in the organization. As per RBI policy, when Bank is in loss, recruitment and promotion inter alia many other privileges get stopped and management is required to seek special approval from the RBI for making recruitment, promotion etc. These PNB management were very much accomplice in corrupt recruitment and promotion practices and there are huge hush money prevalent in SHGB in promotion and recruitment. Even, one criminal complaint is ongoing against the previous Chairman and other management team over corruption & hush money in recruitment and promotion.

As per Bank’s internal information, this year the auditory has found the NPA percentage to be 13%, and incase the NPA percentage goes beyond 10%, the Bank is put into PCA by RBI wherin all recruitment and promotional process stands seized. But again here Bank tried to dodge the system.

And one more thing to note about the recent classification of accounts as NPA – As per Banking norms and statutory guidelines of RBI, whenever any accounts are classified as NPA, the derecognised interest amount are to be reversed from the date of account turning to NPA. So, in these accounts interest for last 4 or 5 years are to be reversed; but in reality, Bank has not reversed interest in many of these newly classified NPA accounts which showed the aggravated profit in the last many years. If the proper classification would have been done, the Bank would have been loss for last 7 years, and the cumulative loss would have been at least 700 crores, however the correct figure can be accessed by the qualified independent auditors or CAG team.

Hence, Sh Mukesh Joshi, Chief Co-ordinator, GGBWO & SHGBOO has moved to regulatory institution such as CAG, RBI, NABARD etc alongwith notifying the PMO as well to look into the matter in the larger public interest and requested to properly investigate the matter to save the Public money which generally belongs to Farmers of Haryana, as 90 percent accounts of SHGB pertain to rural farmers and to stop the SHGB going into the making of another SATYAM – Ramalinga Raju – like frauds, when the Bank is showing the profits in the book, but there is no real Income.

SH MUKESH KUMAR JOSHI

CHIEF CO-ORDINATOR – GGBWO & SHGBOO